As of November 2025, U.S. real estate transaction volume increased by 21% year-over-year. To support this growth, firms increasingly rely on virtual real estate data rooms to securely share deal information. In the private capital space, these platforms support the full investment lifecycle, from marketing and fundraising through investor onboarding and ongoing investor relations.

Below are the best real estate data room tools to support your firm’s growth in 2026.

Top real estate data room tools for investors, sponsors, and CRE teams

Here are seven data room tools supporting the real estate industry and its due diligence process.

1. Agora

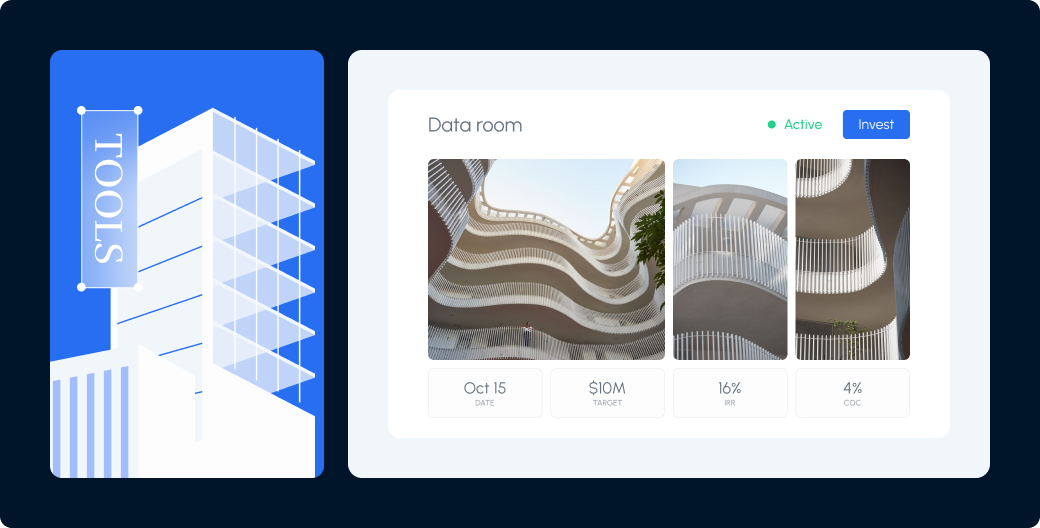

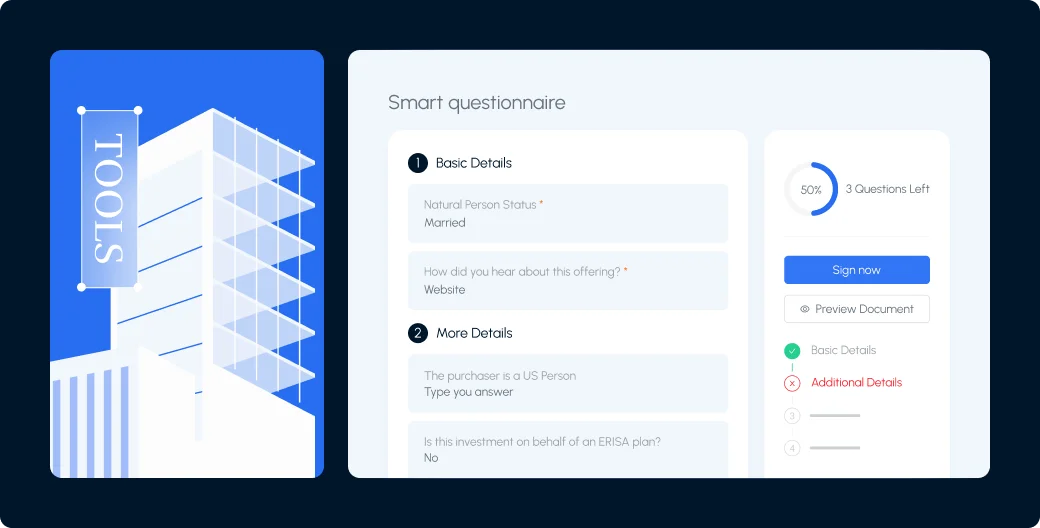

Agora offers a virtual data room as part of its broader commercial real estate investment management platform. The solution provides centralized, secure document sharing and ongoing investor engagement in one system.

Key features:

- Customizable branding: GPs can present deal materials using property images, offering memorandums, projected metrics, and fundraising targets tailored to investor audiences.

- Role-based access controls: Firms share confidential documents and deal content based on investor profiles, permissions, and NDA status.

- Digital subscriptions: Investors looking to commit can electronically review and sign subscription documents directly within the platform.

- Secure document management: Documents stay protected through permission controls and centralized access tracking.

- Platform integration: The data room integrates with Agora’s investor portal, CRM, and third-party tools to centralize information across workflows.

Pricing:

Agora offers three pricing tiers starting at $749/month for the Essentials plan, which includes virtual data rooms, an investor portal, CRM, and a dedicated success manager. The Pro plan includes an institutional-grade virtual data room, advanced reporting, and email marketing tools.

2. Intralinks

Intralinks provides virtual data rooms across financial services, legal, healthcare, energy, and technology for M&A, fundraising, and transaction activity.

Key features:

- Granular permission controls: Administrators manage document access at the user and group level, including view, download, and print restrictions.

- Advanced security: The platform applies encryption, watermarking, and detailed audit trails to track all user activity.

- Due diligence workflows: Built-in Q&A tools, version control, and structured folder hierarchies support complex deal execution.

- Document lifecycle controls: Users set expiration dates, revoke access, and update documents centrally throughout the transaction.

Pricing:

Intralinks has a pay-for-use model. Pricing isn’t publicly listed, but you can contact the company directly for a quote.

3. Datasite

Datasite’s virtual data rooms support industries like healthcare, technology, oil and gas, consumer retail, and real estate. Organizations use the platform for M&A, fundraising, restructuring, and IPOs.

Key features:

- Secure document repository: Central workspace for uploading and organizing confidential files with enterprise-grade encryption and access controls.

- Built-in Q&A workflows: Structured communication and query management that keep questions and answers organized during due diligence.

- AI-enhanced tools: Features such as AI summarization, intelligent redaction, automatic categorization, and multi-language search speed up review and reduce manual effort.

- Activity tracking and analytics: Detailed logs and reporting that show user engagement with documents and project progress.

Pricing:

Datasite doesn’t publish pricing on its website. Contact sales for a customized quote.

4. DealRoom

DealRoom is a broader M&A lifecycle management platform used by corporate development, private equity, and investment teams across technology, healthcare, financial services, and industrial sectors.

Key features:

- Connected diligence workflows: Documents link directly to diligence requests and tasks to keep deal execution organized and traceable.

- Activity tracking and insights: Real-time visibility into document access and engagement helps monitor progress and identify risks.

- Workflow and task management: Built-in tools support deal tracking beyond the data room, including pipeline and integration workflows.

- Search and OCR: Full-text search and optical character recognition, which turns scanned documents into searchable text so key information is easy to find.

Pricing:

DealRoom offers two use-case-based pricing plans at $1,000/month each for due diligence/integration or pipeline. For firms that need both use cases and other advanced features, contact the company directly for a quote.

5. iDeals

Investment banks, private equity firms, law practices, and large enterprises use iDeals for M&A, due diligence, fundraising, IPO preparation, and compliance workflows.

Key features:

- Secure document sharing: Central space for storing and organizing confidential files with enterprise-grade encryption at rest and in transit.

- Advanced security features: Two-factor authentication, watermarking, fence view, and other controls protect sensitive information and prevent unauthorized copying or screenshots.

- Q&A and secure collaboration: Built-in Q&A workflows and commenting tools support inquiry tracking and interaction around deal documents.

- 24/7 multilingual support: Around-the-clock customer support in multiple languages to assist with setup and ongoing use.

Pricing:

iDeals has three pricing tiers, including Core, Premier, and Enterprise, and you can submit your contact information on the website for a quote.

6. Box data rooms for real estate

Box offers virtual data room functionality within its broader content management platform. Industries like financial services, healthcare, legal, real estate, and technology use the solution for due diligence, transactions, and ongoing document management.

Key features:

- Centralized document storage: Store and organize sensitive files in a single repository with encryption at rest and in transit.

- Security and compliance controls: Support for multi-factor authentication, watermarking, and compliance with industry standards such as HIPAA and GDPR.

- Activity tracking: Visibility into file access and user activity to support oversight and audits relating to property sales and the due diligence process.

- Workflow tools and integrations: Workflow automation and integrations with tools like Microsoft 365 and Salesforce to support document-based processes.

Pricing:

For the Box capabilities needed to support a virtual data room solution, pricing starts at $47/month per user with a minimum of three users for the Enterprise plan. Enhanced capabilities like AI tools require the Enterprise Plus plan, which is $50/month per user.

7. Dropbox DocSend

Dropbox DocSend provides secure document sharing with optional virtual data room functionality. Use cases include venture capital, startups, and sales teams for fundraising, deal sharing, and confidential document distribution.

Key features:

- Secure link sharing: Create unique links to share documents instead of email attachments, with options like passcodes, link expiration, and email gating to control who can access files.

- Watermarking and dynamic access control: Apply watermarks to sensitive content and revoke access after sharing to protect confidential information.

- One-click NDA gating: Require viewers to accept an NDA before accessing documents to help streamline compliance workflows.

- Integration with cloud storage and email: Import files from services like Dropbox, Google Drive, and OneDrive and share directly from Gmail or Outlook.

Pricing:

Dropbox’s virtual data room capabilities require the Advanced pricing plan, which is $30/month per user with a minimum of three users.

Real estate data room tools comparison overview

Below is an at-a-glance comparison of each tool and its primary use case for real estate documents and the due diligence process.

| Tool | Primary use case | Security and access controls | Best for |

| Agora | CRE investment document sharing | Role-based access, NDA gating, investor-specific permissions | Real estate sponsors raising and managing private capital |

| Intralinks | Real estate mergers | Granular permissions, encryption, and audit trails | M&A, corporate finance |

| Datasite | Deal lifecycle and due diligence | Enterprise encryption, detailed audit logs | Investment banking, private equity deals |

| DealRoom | M&A lifecycle and project tracking | User and document permissions, activity analytics | Deal execution |

| iDeals | Secure deal management sharing | Watermarking, multi-factor authentication, and audit logs | Private equity and legal transactions |

| Box data rooms | Secure content storage and file sharing | Encryption, MFA, and compliance controls | General industry secure data sharing |

| Dropbox DocSend | Secure link sharing & engagement tracking | Watermarks and passcodes | Document sharing for broader industries |

Why real estate professionals need data rooms

Real estate deals involve sensitive information, multiple stakeholders, and tight timelines. This can create challenges for traditional file-sharing tools. Data rooms specific to real estate protect your firm, organize information, and support investor relationships.

Protect sensitive data

During the evaluation of real estate projects, both sponsors and investors handle sensitive data that requires protection. GPs put significant time and effort into vetting and underwriting deals. Keeping this information secure means restricting access to potential investors based on where they are in the due diligence process.

Then, when investors commit to a project, they also share sensitive personal and financial information. Data room features like secure access and data encryption increase confidence in how your firm manages and protects its data.

Keep real estate projects organized

Real estate transactions involve large volumes of information, and managing it across emails, folders, and spreadsheets gets difficult quickly. Firms need efficient communication with quick access to deal materials in one place, so it’s easier for stakeholders to review key information, like:

- Financial statements: Multi-year P&L statements, balance sheets, cash flow, and historical occupancy or vacancy data.

- Projections and metrics: Proforma assumptions such as anticipated IRR, cash-on-cash return, equity multiple, and sensitivity analysis across scenarios.

- Property details: Transaction-specific documents like appraisals, surveys, environmental reports, and capital expenditure histories.

Enhance investor experience

Virtual data rooms present a professional image to investors with an organized space to review deal information. Instead of sending files back and forth or answering the same questions over and over, sponsors can share everything in one secure location.

Investors have self-service access to review materials on their own time and make investment decisions. Firms that make this process easy for investors build trust and reduce friction during the capital raising stage of a project.

Key features to look for in real estate data room tools

The right data room depends on how your firm operates and which features support your day-to-day workflows. Key capabilities to include in your evaluation criteria are:

- Role-based access and granular permissions: Not everyone should have the same information at the same time. A data room should offer secure file sharing with the ability to control access by user and stage of the process.

- Document versioning and automated audit trails: Real estate documents change over time. A data room should keep everyone working from the latest version and show who accessed or updated files so things stay organized.

- Integrated Q&A and communication workflows: Investors may have questions about the project. A data room should keep those questions and responses tied to the relevant documents so that context doesn’t get lost as discussions move forward.

- Bulk uploads and structured folder hierarchies: Real estate deals involve many critical documents. The right data room allows you to upload files in batches and organize them in a folder structure so stakeholders know exactly where to look.

- Integration with CRM and investor relations systems: Integrated systems let you include investor-specific details and support investors as they move from interest through funding in one centralized platform.

- Transparent pricing and included features: Look for simple pricing that makes it easy to understand what is included, any pay-per-use costs, and which features require higher tiers.

How to choose the right real estate data room tool

To narrow down the options available, start with criteria that support your specific business needs.

| Business need | What to evaluate | Impact |

| Use cases | Fundraising, acquisitions, asset management, or portfolio use | Different tools support different stages of the real estate lifecycle |

| Investor experience | Ease of access, clarity, and self-service review | A smoother experience builds confidence and reduces friction |

| Security and compliance | Access controls, encryption, audit trails, and security certifications | Sensitive financial and personal data requires strong protection |

| Scalability | Ability to support multiple deals and investors | Tools should work as your deal volume and portfolios grow |

| Integration | CRM, reporting, and investor management | Fewer systems reduce manual work and errors |

| Ongoing use | Support beyond due diligence and closing | Ability to use data rooms for reporting and investor relations |

Details on these criteria and use case areas include:

- Define your use case: fundraising, acquisitions, or asset management: Start by defining how you plan to use a virtual data room. Do you need to support fundraising, portfolio management, or organize documents for multiple real estate projects? Your use case will help define the features and capabilities you should look for.

- Evaluate security, compliance, and reporting needs: Look for features like encryption at rest and in transit, role-based access controls, dynamic watermarks, audit logs, activity reporting, and support for relevant compliance standards.

- Consider external user experience for investors and buyers: Prioritize a user-friendly interface that’s easy to navigate so that all parties can easily access and find information.

- Assess scalability across multiple deals and portfolios: The best virtual data rooms scale to support many real estate development projects and investor relationships as you grow.

Why Agora stands out for real estate data rooms

Agora’s data rooms support the specific needs of private equity firms in the real estate industry with capabilities like:

- Built-in data rooms connected to investors, deals, and reporting: Agora links investor access to specific offerings, providing personalized data rooms and tracking engagement within the CRM.

- Designed specifically for CRE ownership and investment workflows: The platform supports sponsors as they present properties, raise capital, and manage investor relationships from initial diligence through ongoing reporting.

- Seamless transition from fundraising to ongoing investor management: Investors can go from reviewing a deal straight into onboarding, then continue using the same interface to access portfolio details, updates, and new opportunities.

- Reduced tool sprawl with CRM, reporting, and data rooms in one platform: Instead of juggling separate tools for fundraising, investor tracking, and reporting, everything lives in one place.

Conclusion

Data rooms give your firm a professional approach to raising capital. The right solution supports an integrated approach to the entire investor lifecycle and enhances the investor experience while reducing back-office operational burden.

See how Agora’s real estate data rooms support faster capital raises and increase investor engagement today.

![AppFolio alternatives: Best property management platforms compared [2026]](https://res.cloudinary.com/de1ep59a0/images/v1768801446/Appfolio-alternatives_cover-02/Appfolio-alternatives_cover-02.webp?_i=AA)

![Yardi pricing guide: Plans, features & cost comparisons [2025]](https://res.cloudinary.com/de1ep59a0/images/v1765896745/Agora-vs.-Yardi/Agora-vs.-Yardi.webp?_i=AA)