CAPITAL CALLS

Streamline your capital calls

Trusted by 700+

customers worldwide

Efficient and automated

capital calls

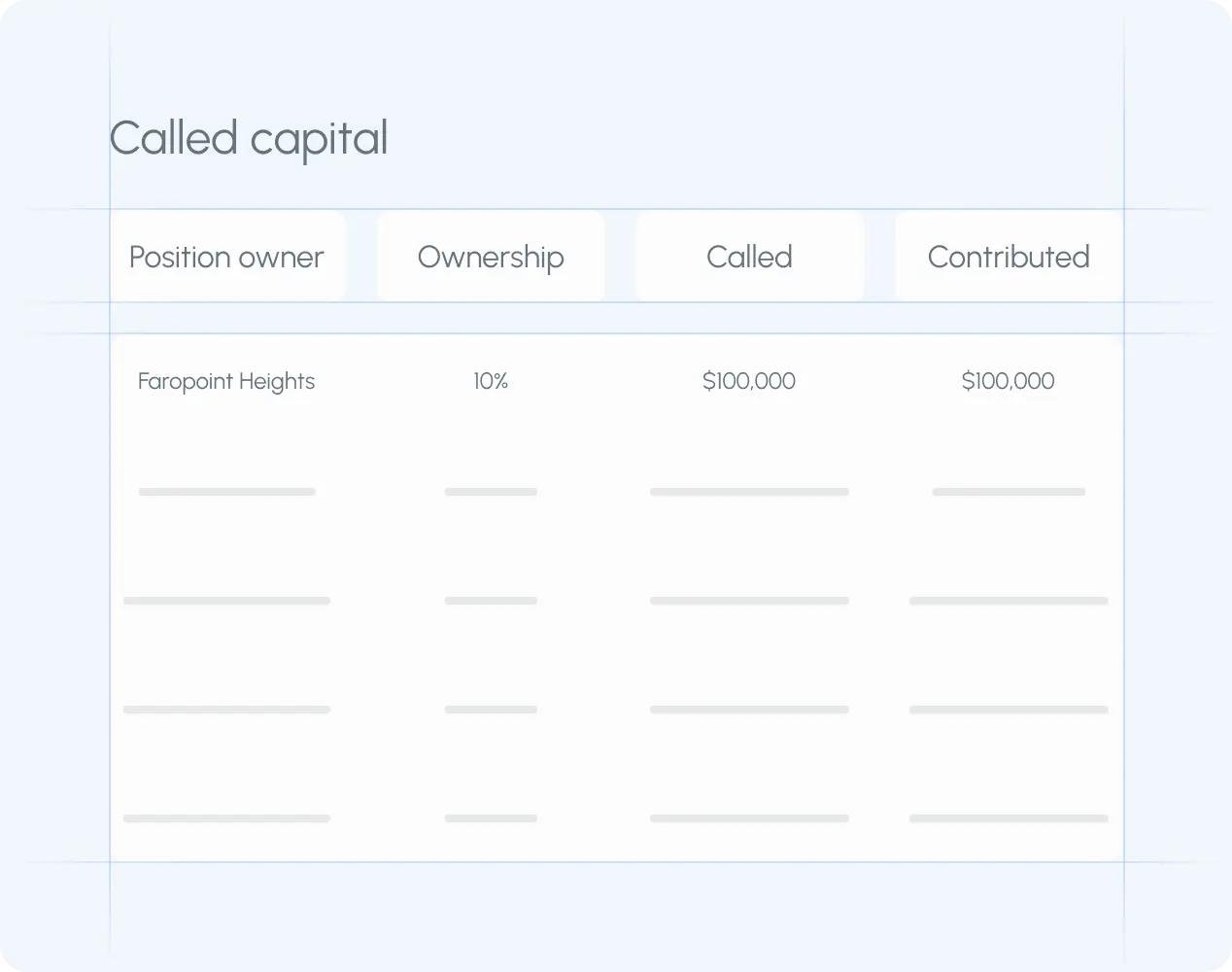

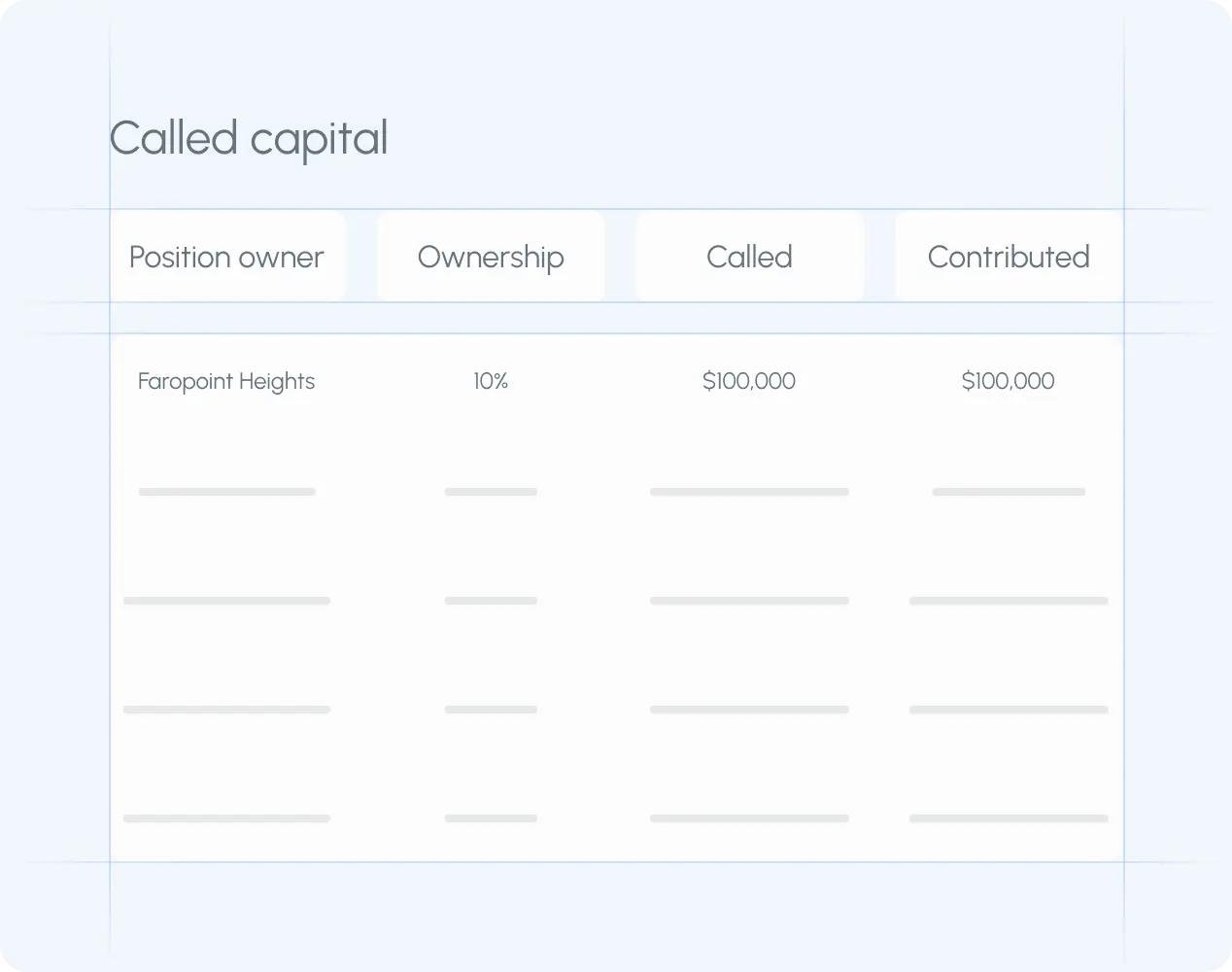

Automated capital call calculations

Automatically calculate the capital needed from each investor based on their position in the cap table. This ensures accurate and effortless capital requests and guarantees that investors fund the correct, predefined amount or percentage of capital with ease.

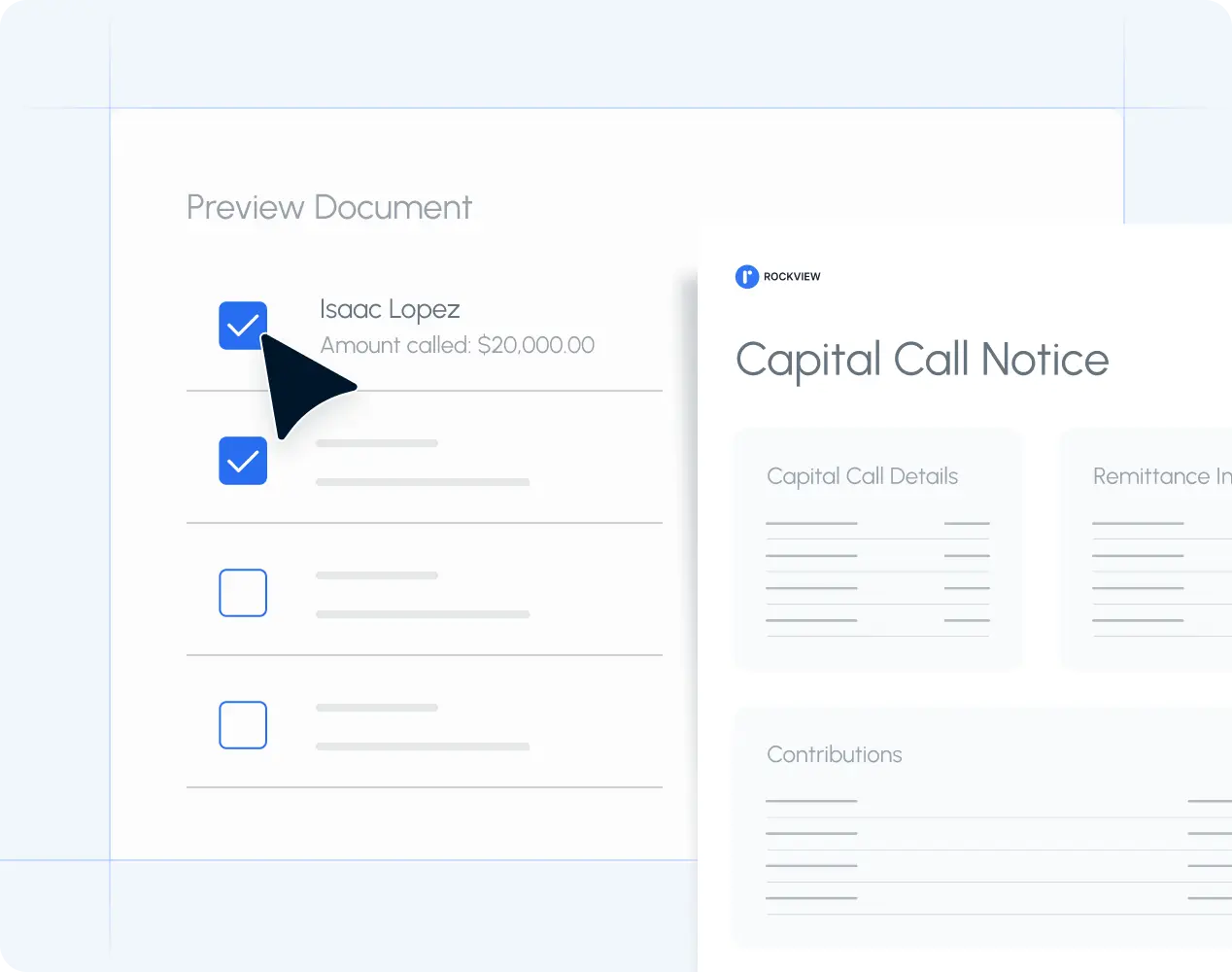

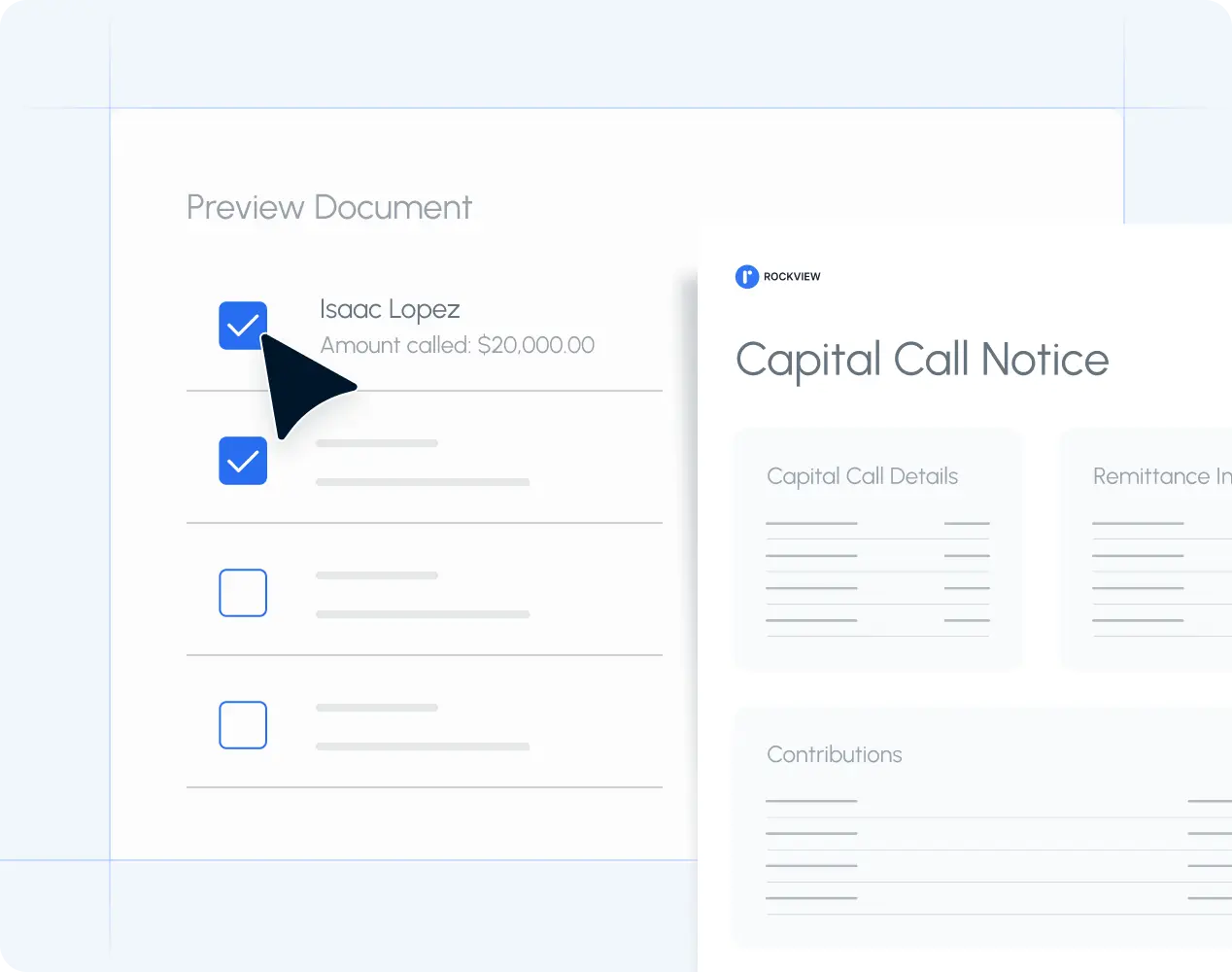

Customized capital call notices

Generate personalized and branded capital call notices automatically for each investor based on predetermined calculations. These notices are sent via email and displayed on their portal, ensuring clear communication and enhancing investor confidence.

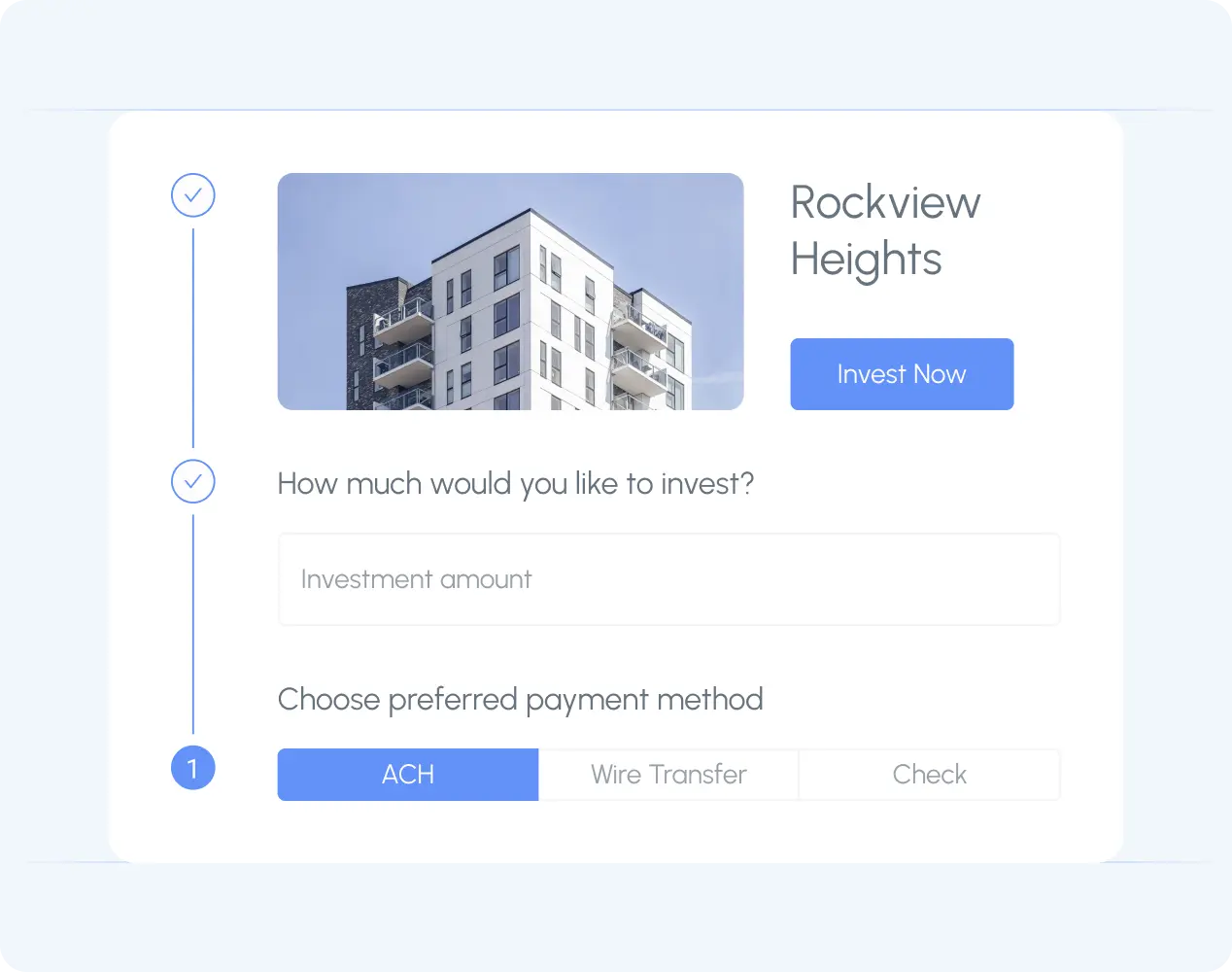

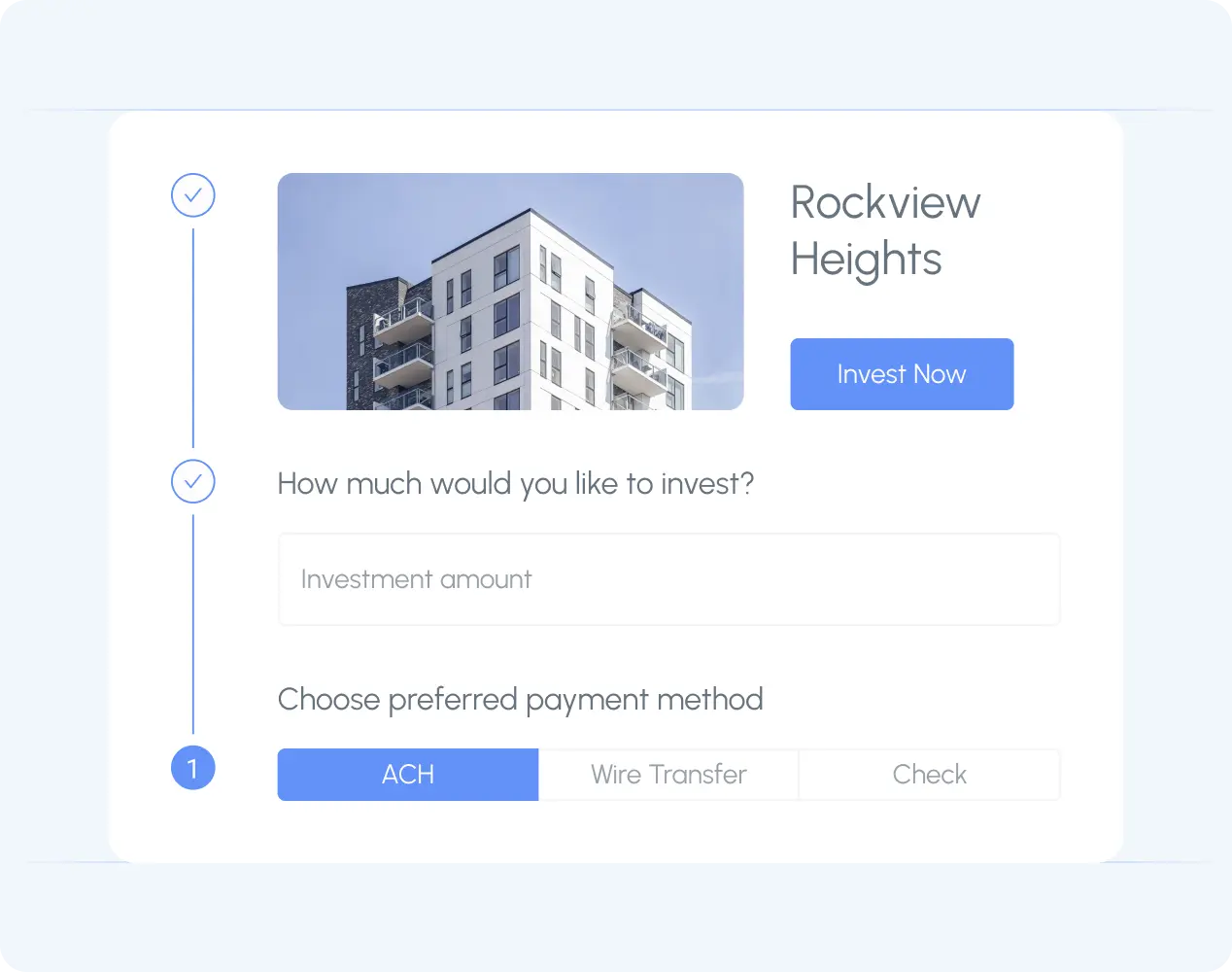

Seamless funding through the Investor Portal

Enable investors to easily fund their capital calls directly through the portal and manage their funded and unfunded capital with the payment manager. This provides clear visibility into funding statuses.

Real people, real results

Leading the market in customer satisfaction

See all reviews

4.8

4.8What is a capital call and why is it important in real estate investing?

A capital call is a request from an investment manager to investors, asking them to contribute their committed capital to a fund. This process is crucial in real estate investing as it ensures that the necessary funds are available for new investments, ongoing projects, or operational needs. Timely capital calls help maintain liquidity and enable the fund to seize investment opportunities as they arise.

How are capital call amounts determined for each investor?

Capital call amounts are determined based on each investor’s commitment and their position in the capital structure. The calculations take into account the total amount of capital needed and distribute it proportionally among the investors according to their agreed-upon contributions. This ensures that each investor funds the correct, predefined amount or percentage of capital.

How does Agora's platform automate the capital call process?

Agora’s platform automates the capital call process by:

- Automated capital call calculations: Automatically calculating the capital needed from each investor based on their cap table position.

- Customized notices: Generating personalized and branded capital call notices that are sent via email and displayed on the investor’s portal.

- Seamless funding: Allowing investors to fund their capital calls directly through the portal, managing their funded and unfunded capital efficiently. This automation reduces manual effort, ensures accuracy, and enhances communication with investors.

Can Agora's platform handle capital calls for complex entity structures?

Yes, Agora’s platform is designed to handle capital calls for complex entity structures. It can accommodate diverse investment vehicles, including open-end funds, debt vehicles, and class-based waterfalls. The platform’s flexibility ensures accurate and efficient capital call management regardless of the complexity of the investment structure.

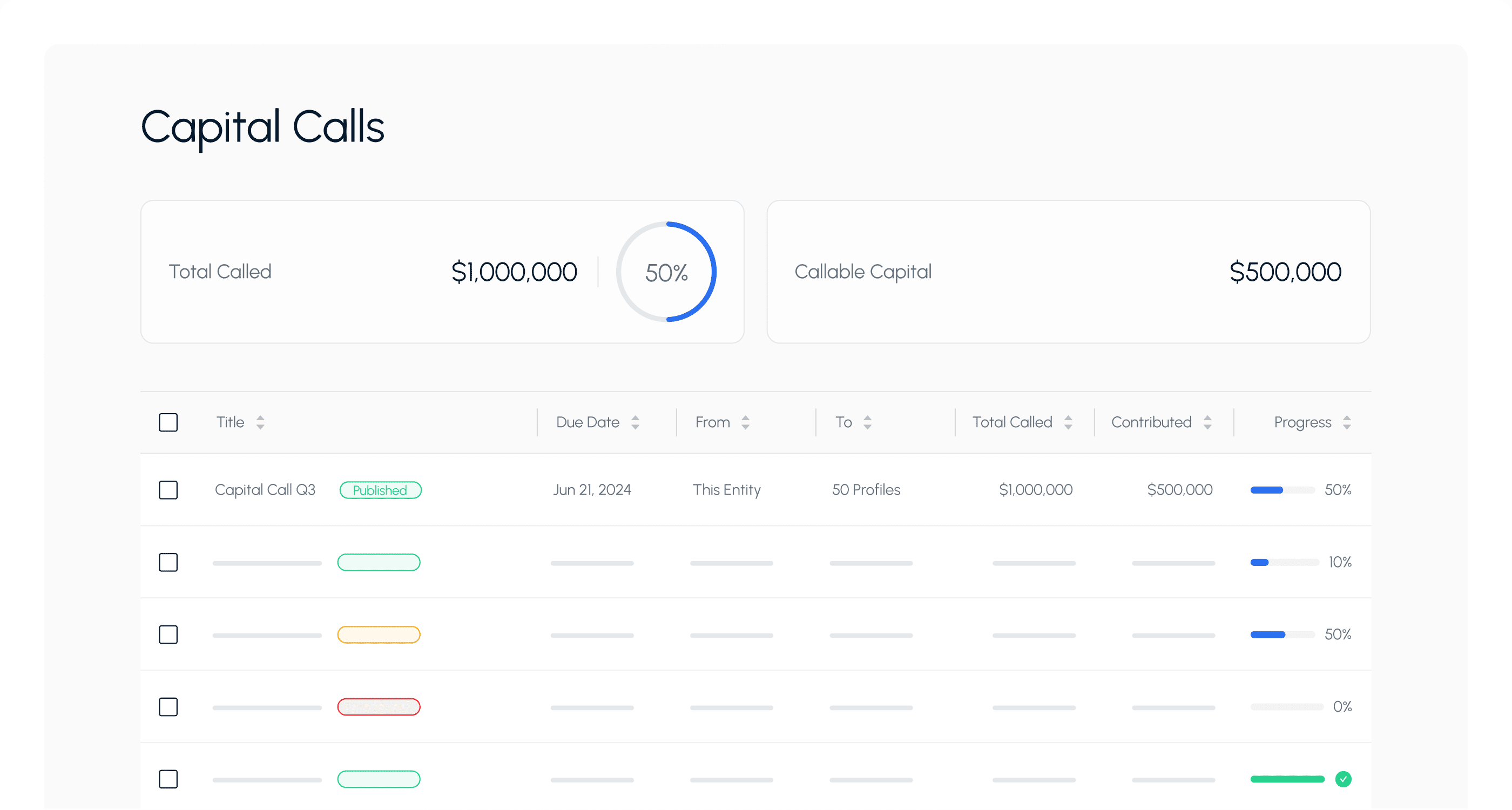

How can Agora's platform help manage multiple capital calls efficiently?

Agora’s platform helps manage multiple capital calls efficiently by:

- Centralized management: Providing a single dashboard to track and manage all capital calls.

- Full visibility: Offering real-time visibility into the status of each capital call, including funded and unfunded amounts.

- Automated processes: Automating calculations and notifications, ensuring that each capital call is handled accurately and promptly. This streamlines the entire process, saving time and reducing the risk of errors.

Read more about how Agora can help streamline your real estate investment management operations here.