Just released: The Operating Mindset of Running a Fund — a fund admin roundtable discussion. Watch now

AUTOMATED KYC/AML VERIFICATION

Effortless, fully compliant

KYC/AML verification

Trusted by 900+

customers worldwide

“With Agora I can simply click and upload the K-1s as a collection of documents, and just like that, each person receives the correct K-1."

Lynn Glantz

Head of Investor Relations“With Agora, we no longer have to spend time on the nitty gritty parts of our tax operations – we just send them raw data and they do it all for us.”

Rebecca Park

Associate Director of Financial Operations“Agora has been extremely helpful in streamlining our whole back-end operations and centralizing the whole investor experience.”

Chelsea Deluca

Chief Operating Office“The dedicated support from Agora’s customer success team has been transformative for us.”

Mike Doney

Operating Officer“Agora streamlined our investor onboarding, what used to take hours now takes just minutes. Investors complete entire subscription docs in 8-10 minutes."

Matt Stein

Chief Development Officer“With Agora, I’ve cut communication efforts by 50-75%. Uploading documents, K-1s, and investment statements has never been easier”

Ryan Clintworth

Principal“Agora is more than a solution; it's a partner. It solves our operational needs securely, saves us time, and is built to grow with us for the long haul."

Nicole Warwood

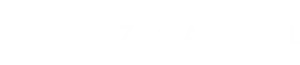

Chief Financial OfficerAutomated KYC/AML

for secure onboarding

Seamless verification

Accelerate investor onboarding with integrated KYC/AML verification that keeps your firm compliant and secure. Automate screening within the subscription process to eliminate friction while upholding the highest standards of compliance and data security.

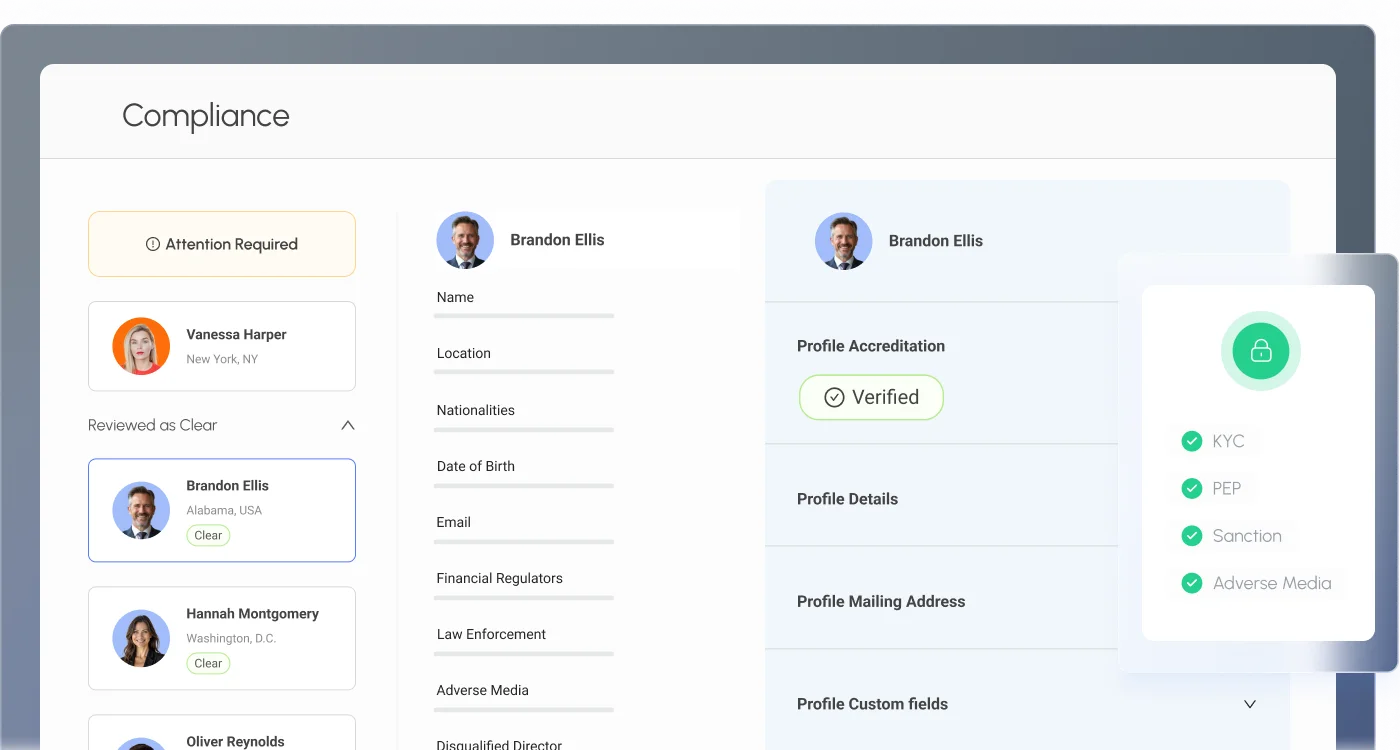

Ensure compliance and build trust

Safeguard your firm and maintain SEC and FinCEN compliance without disrupting investor experience. Investor-friendly verification flows streamline compliance, reduce risk, and foster trust as your firm grows.

Scale with security and confidence

Expand your investor network with institutional-grade security and continuous risk monitoring. Every profile is screened against global sanctions, such as OFAC, and checked for PEP and adverse media, with ongoing screenings to ensure continuous compliance and protection

Real people, real results

What is automated KYC/AML verification?

Automated KYC (Know Your Customer) and AML (Anti-Money Laundering) verification is a technology-driven process that verifies investors’ identities and assesses potential risks in compliance with financial regulations. It automates identity verification, background checks, and ongoing monitoring to ensure firms meet regulatory requirements while streamlining investor onboarding.

Why is KYC/AML compliance important for investment firms?

KYC/AML compliance helps investment firms prevent financial crimes, such as money laundering and fraud, by verifying investor identities and assessing potential risks. It ensures compliance with SEC, FinCEN, and global regulations, protecting firms from legal penalties, reputational damage, and financial loss.

How does automated verification improve investor onboarding?

Automation eliminates manual processes, making onboarding faster, more secure, and hassle-free.

- Reduces onboarding time from hours to minutes

- Integrates seamlessly into subscription workflows

- Enhances security while minimizing investor friction

Learn how you can optimize your onboarding experience with Agora’s fundraising and onboarding solutions.

What regulations does Agora’s KYC/AML verification comply with?

Agora’s KYC/AML verification aligns with key regulatory frameworks, including:

- SEC (Securities and Exchange Commission)

- FinCEN (Financial Crimes Enforcement Network)

- USA PATRIOT Act & Bank Secrecy Act (BSA)

- Global sanctions and PEP (Politically Exposed Persons) lists

- GDPR & data protection standards

- Can Agora’s KYC/AML solution integrate with existing investment platforms?

How does Agora protect investor data during the verification process?

Agora employs bank-grade encryption, secure cloud storage, and strict access controls to safeguard investor data. Compliance with GDPR and financial data security standards ensures all personal and financial information remains protected throughout the verification process.