Just released: The Operating Mindset of Running a Fund — a fund admin roundtable discussion. Watch now

OPEN-ENDED FUNDS

Manage open-ended

funds easily

Trusted by 900+

customers worldwide

“With Agora I can simply click and upload the K-1s as a collection of documents, and just like that, each person receives the correct K-1."

Lynn Glantz

Head of Investor Relations“With Agora, we no longer have to spend time on the nitty gritty parts of our tax operations – we just send them raw data and they do it all for us.”

Rebecca Park

Associate Director of Financial Operations“Agora has been extremely helpful in streamlining our whole back-end operations and centralizing the whole investor experience.”

Chelsea Deluca

Chief Operating Office“The dedicated support from Agora’s customer success team has been transformative for us.”

Mike Doney

Operating Officer“Agora streamlined our investor onboarding, what used to take hours now takes just minutes. Investors complete entire subscription docs in 8-10 minutes."

Matt Stein

Chief Development Officer“With Agora, I’ve cut communication efforts by 50-75%. Uploading documents, K-1s, and investment statements has never been easier”

Ryan Clintworth

Principal“Agora is more than a solution; it's a partner. It solves our operational needs securely, saves us time, and is built to grow with us for the long haul."

Nicole Warwood

Chief Financial OfficerComprehensive open-ended

fund management

Streamlined cash management

Simplify capital transaction management to keep your finances organized. Manage all cash movements, track transactions, and adjust cap tables effortlessly, ensuring your financial operations are streamlined and easily accessible.

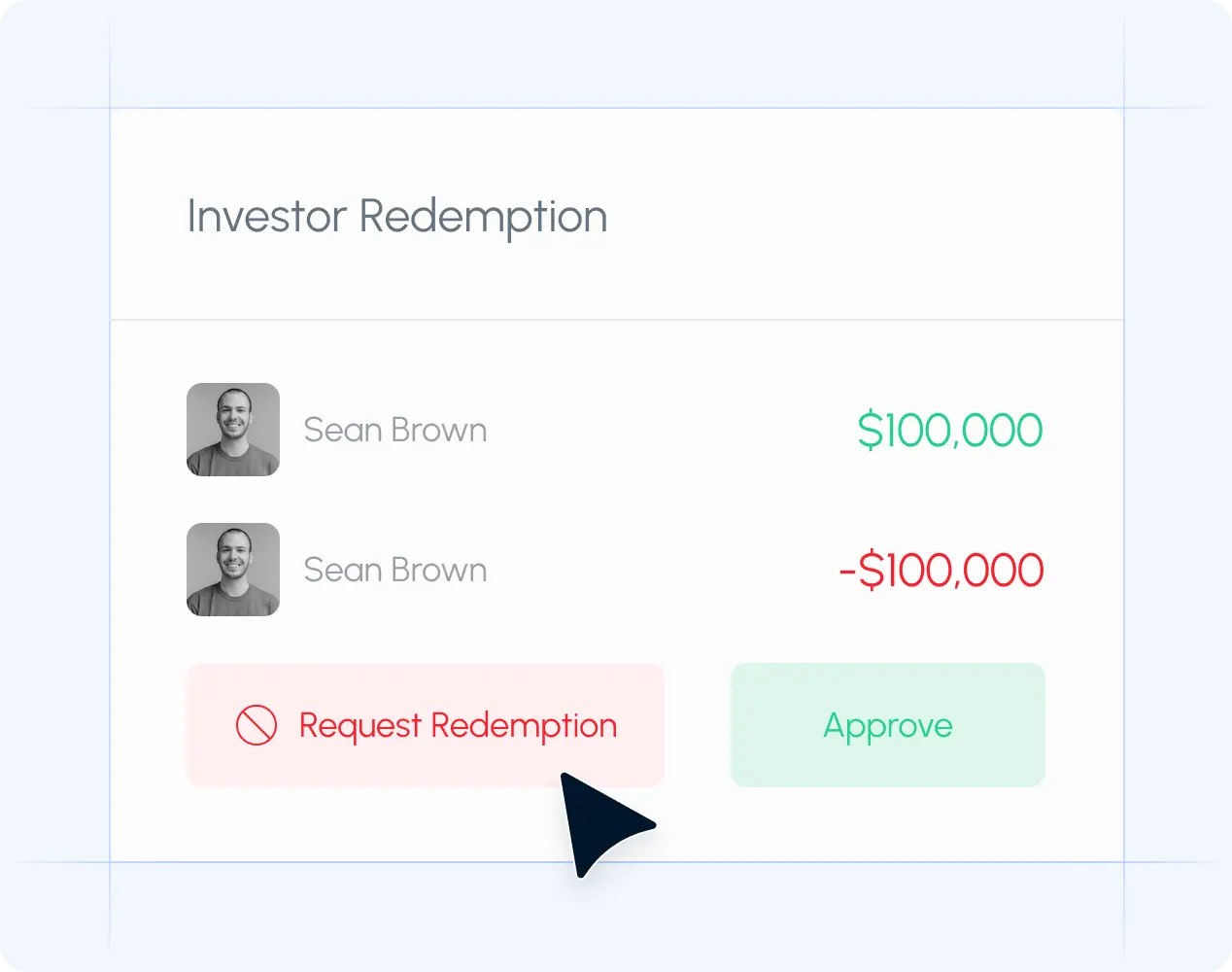

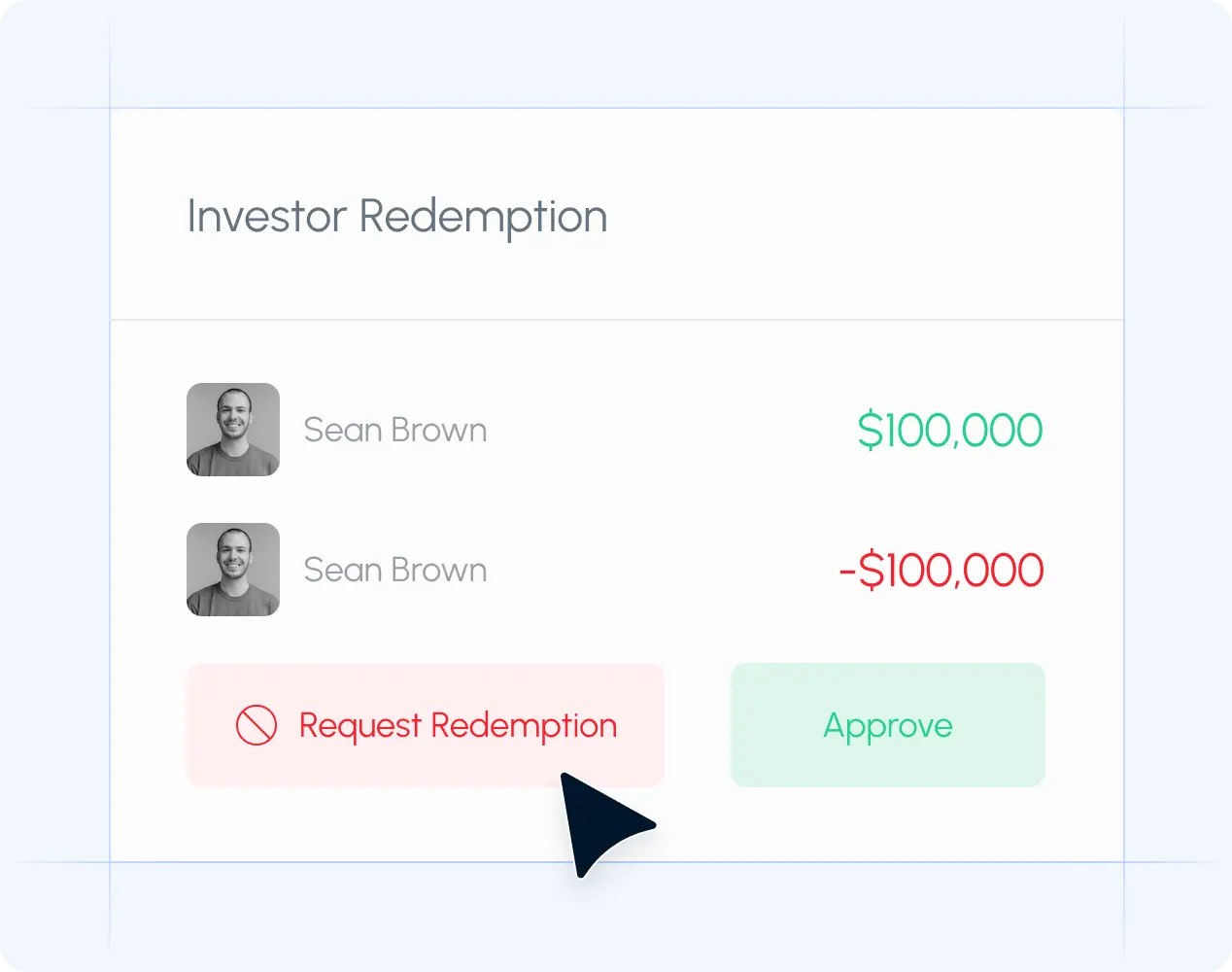

Easy investor redemption management

Effortlessly manage partial or full investor redemptions, providing liquidity and flexibility while ensuring seamless withdrawals. Maintain operational efficiency and meet regulatory requirements with ease.

Accurate unit price tracking

Track different unit prices efficiently, allowing accurate calculation of investor ownership in open-ended funds. Maintain accuracy and transparency in unit-based configurations.

Real people, real results

What is an open-ended fund, and how does it differ from other types of funds?

An open-ended fund is a type of investment fund that allows investors to buy and sell shares continuously, without a fixed maturity date. This flexibility distinguishes it from closed-ended funds, which have a set number of shares and typically trade on an exchange.

Open-ended funds provide liquidity by pricing shares based on the net asset value (NAV) of the fund, allowing investors to enter or exit the fund at regular intervals. This structure offers greater flexibility and access to capital but requires careful management of cash reserves and investor redemptions to ensure the fund’s stability.

What are the key considerations for managing investor redemptions in open-ended funds?

Managing investor redemptions in open-ended funds requires careful planning to ensure liquidity and compliance with regulations.

- Maintain adequate cash reserves.

- Communicate clear redemption policies to investors.

- Monitor the impact of redemptions on fund performance.

Effective redemption management ensures operational efficiency and investor satisfaction. Learn more about how Agora can improve your investor relationship management here.

How does Agora simplify cash management for open-ended funds?

Agora simplifies cash management by automating capital transactions and providing real-time tracking of all cash movements by:

- Automating cash flow tracking and reporting.

- Effortlessly adjusting cap tables with each transaction.

- Centralizing financial operations for easy access.

This automation streamlines financial management and enhances transparency. Learn more about Agora’s cap table management here.

How does Agora's platform ensure transparency and accuracy in unit-based pricing?

Agora ensures accurate unit-based pricing by tracking different unit prices and automatically calculating investor ownership including:

- Tracking unit prices for various classes.

- Automatically updating ownership based on unit value.

- Providing clear, transparent reporting to investors.

This accuracy fosters trust and confidence in your fund management.

How does Agora address the challenge of tracking and adjusting cap tables in open-ended funds?

Agora addresses cap table challenges by automating adjustments with each capital transaction, ensuring real-time accuracy with:

- Automatically updates cap tables with new investments or redemptions.

- Tracks changes in ownership and unit pricing.

- Provides detailed, transparent records for easy review.

This real-time tracking simplifies cap table management and enhances operational efficiency. Learn more about Agora’s cap table management here.