When tax season approaches, we recognize the pressures it places on GPs. To alleviate this stress, we offer tech-enabled tax returns & K-1 preparation and delivery services. Our service gets you swiftly set up with a dedicated CPA coupled with an integrated Tax Center dashboard, part of our comprehensive investment management platform. Experience a seamless, delay-free tax operation that guarantees accurate, compliant, and timely filing.

Here’s how the Tax Center works

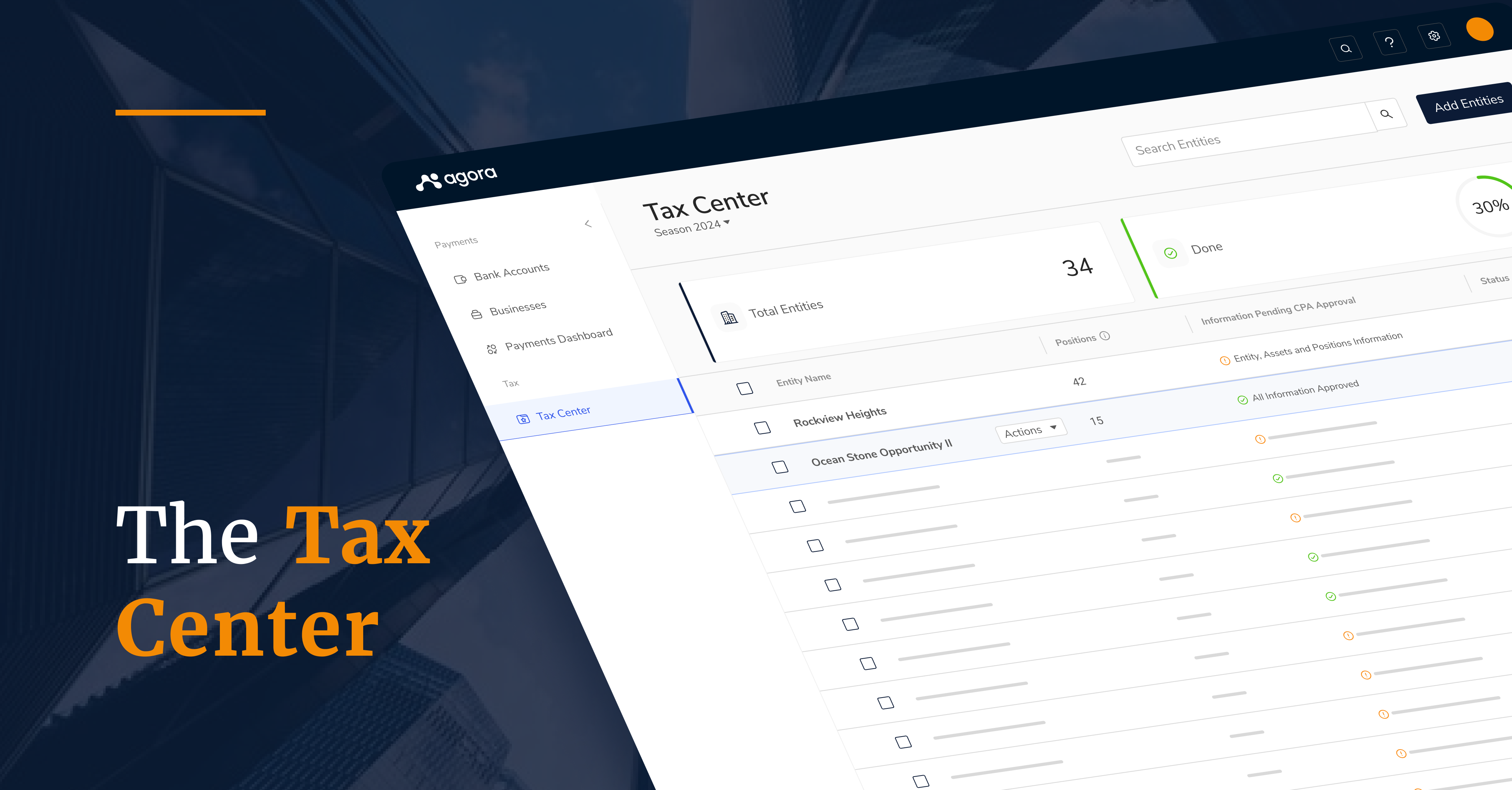

Oversee the preparation status of all your tax returns

The Tax Center allows you to manage and monitor all entities in need of tax preparation and filing. With a clear display of total entities and their readiness for tax filing, you consistently have a high level status update on all your entities tax preparation progress.

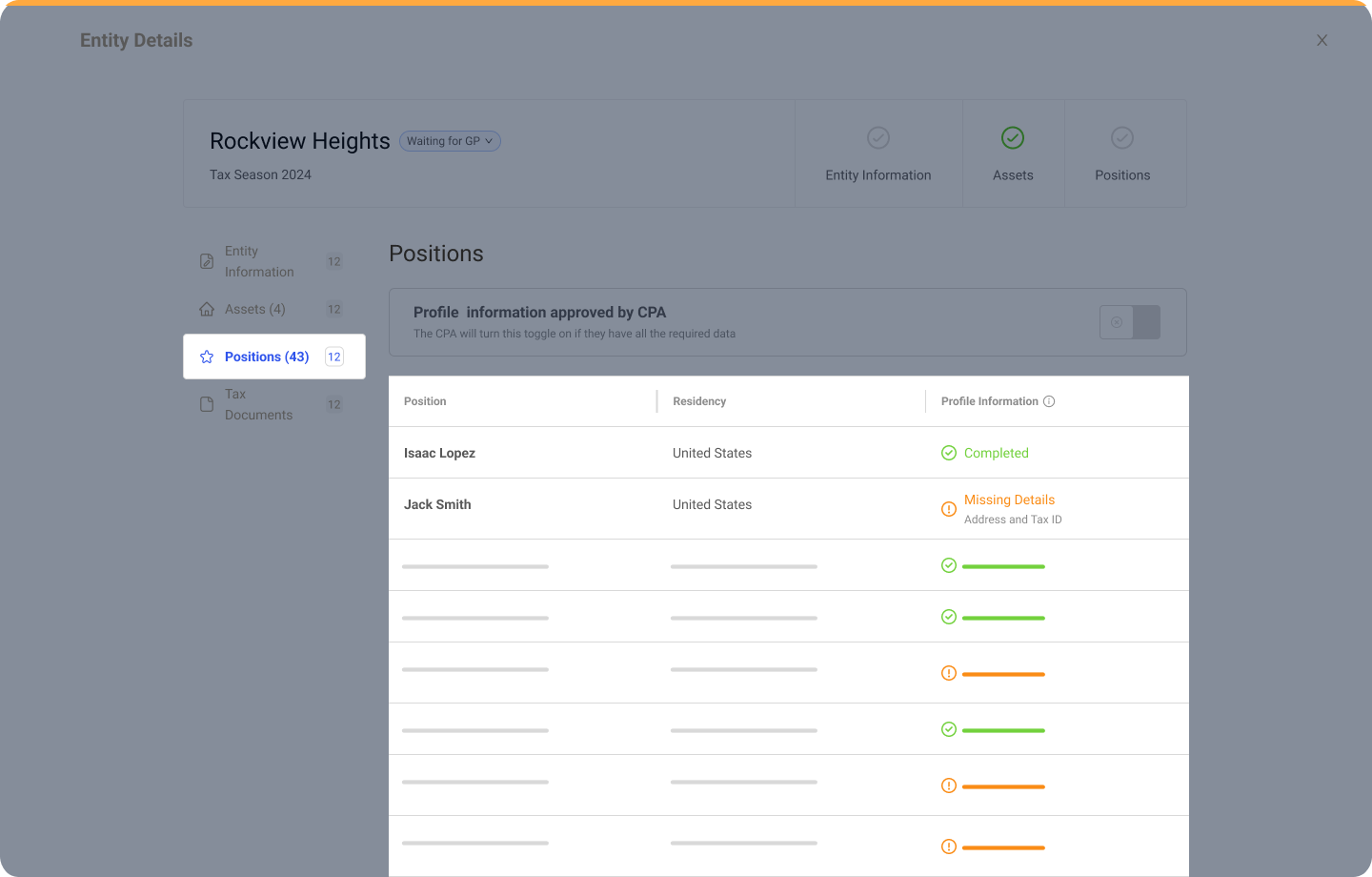

Manage each entity’s tax preparation on a unique page

In the Tax Center, each entity has a dedicated page displaying a detailed overview of its tax preparation status and documents. In each section, you’ll find a clear list of the information required by your CPA to prepare the 1065s and K-1s. This setup helps ensure that all essential details, such as investor information for K-1s and documents, signatures, and asset data for 1065s, are easily accessible and verifiable by your CPA.

Each entity page is organized into the following sections

- Entity & asset information – In this section, you’ll find a list of required documents such as last year’s tax return (Form 1065), partnership agreements, and entity formation documents, essential for your CPA to prepare the 1065s. Once your CPA reviews and approves each document, they can activate the ‘approved’ toggle, offering you clear visibility into the process.

- Investor position information – Here, you’ll see a list of all investors for a particular entity, including names, residency, and profile status. This page highlights any missing investor K-1 related information, allowing you to quickly navigate to investor profiles to see what’s missing. As you update the missing details, the system automatically updates. Once complete, the investor profiles are marked as completed for CPA review.

Track the status for the preparation of each entity

On each entity page in the tax center, you and your CPA can see real-time updates. Whether you’re working on gathering and uploading documents to upload for your CPA to see, or if you’re waiting for your CPA to approve your submissions, the Tax Center’s status indicators keep you and your CPA informed every step of the way.

Export and review your data

Once all investors’s tax information is gathered and approved, your CPA can easily export data for review. The Tax Center generates an Excel file in the exact format needed by your CPA, expediting the review process.

Centralize all your documents

Say goodbye to scattered tax documents. Once the K-1s and 1065s are ready, your CPA will upload them to the Tax Documents tab. This ensures all your key documents are organized in one place, easily accessible to you and ready for our team to distribute to investors.

Upload K-1’s to investors in bulk

After your CPA provides the necessary K-1s, our team will upload all the tax returns to your investors directly through the Tax Center for easy access and timely distribution.

Now that you know the key features of Agora’s Tax Center and how to use it, let’s unpack the core benefits of our Tax Service.

Benefits of Agora’s Tax Service

1. Faster filing and top service

Our expert CPAs will file your tax returns and send the K-1s to your investors within 14 days of receipt of all the required documents, maintaining impeccable investor relations.

2. Cut costs by at least 50%

Our tech-driven process enables us to significantly lower rates and offer competitive prices compared to traditional CPA services, with a flat rate per entity. Learn how Gel-fund saved $40,000 using the tax service.

3. Save time and resources

For companies already using Agora’s platform, our technology simplifies tax preparation by automatically inputting 50%-70% of the data required for tax filing. This significantly reduces your administrative burden so you can focus on expanding your business.

4. Improve organization and transparency

No more needless back-and-forths with your CPA. Manage documents and communications conveniently from the Tax Center, located within your Agora dashboard.

5. Fully integrated solution

The tax center is a key part of our comprehensive investment management platform, designed to optimize your operational efficiency across the board.

Embrace our simple and modern approach toward tax season

As we move forward, the Tax Center will continue to evolve, incorporating feedback and adapting to the ever-changing landscape of tax regulations and client needs. It’s not just a feature; it’s our commitment to you, ensuring that every tax season is smoother and more manageable than the last.

Join us in embracing a future where tax season is no longer a source of stress but a streamlined, well-managed process that you control. Welcome to the Tax Center, your new ally in the world of real estate tax management.