Key takeaways

- Pricing models differ, with InvestNext offering tiered subscriptions starting at $499 per month and scaling to enterprise plans, while SyndicationPro uses EUM-based pricing that requires direct consultation for quotes.

- Core feature overlap includes white-label investor portals, CRMs, and fundraising tools, enabling sponsors to manage capital raises, investor communications, and deal marketing within a centralized platform.

- Operational focus areas show InvestNext emphasizing automated distributions, accreditation, and KYC AML verification to reduce admin workload, while SyndicationPro supports IRA investments, soft commitments, and co-sponsor collaboration to streamline capital raising.

- Implementation and support highlight fast onboarding claims from both platforms, with InvestNext reporting rapid ticket resolution and high satisfaction, and SyndicationPro offering data migration within 2 to 7 business days plus weekday phone support.

- User feedback metrics indicate strong satisfaction for both tools, with InvestNext earning higher review volume and SyndicationPro achieving slightly higher average ratings despite a smaller sample size.

Choosing the right real estate investment management software can be a daunting task, but it helps to compare your options side by side. InvestNext and SyndicationPro are both platforms to consider. In this article, we dive into their features, pros and cons, pricing, and more.

InvestNext overview

Launched in 2016, InvestNext is a real estate investment management platform. Some of its core features include:

- White-label investor portal for promoting offerings and raising capital

- CRM for GPs to manage relationships with LPs

- Real-time collaboration with co-sponsors

SyndicationPro overview

Part of the SponsorCloud suite, SyndicationPro is a real estate investment management platform that has been around since 2018. Among other things, it offers:

- Funding from self-directed IRA accounts via Equity Trust Company

- ACH payment distributions

- CRM with lead segmentation and automated messaging

InvestNext vs SyndicationPro: Pros & cons

| InvestNext | SyndicationPro | ||

| Pros | Cons | Pros | Cons |

| High number of reviews on G2 and Capterra | Relatively low 4.5 average user rating on G2 | Good ratings across G2 and Capterra | Low number of reviews on G2 and Capterra |

| Scalable pricing | No dedicated mobile app | Real-time collaboration with co-sponsors | Intransparent pricing |

| Video tutorials for easy setup | Potentially steep learning curve due to many features | Supports IRA investments | No dedicated mobile app |

InvestNext vs SyndicationPro: Key differences

Here are areas in which InvestNext and SyndicationPro differ and overlap:

Top features

Both InvestNext and SyndicationPro offer white-label investor portals, CRMs, and other tools for raising capital.

Some of InvestNext’s top features include customizable deal rooms, ACH transfers, and e-signatures for streamlining the fundraising process, while some of SyndicationPro’s top features include real-time co-sponsor collaboration, automated investor accreditation verification, and automated lead messaging.

Pricing

InvestNext’s Core plan starts at $499 per month (billed annually). It includes the custom investor portal, investor CRM, fundraising automation, automated back office and distributions, and investor reporting. Features like KYC/AML verification, investor accreditation letters, and ACH payment processing are typically paid add-ons in this plan. The Firm Plan unlocks unlimited users, support for up to 10 co-sponsors, and includes a dedicated account manager and priority migration. The highest custom-priced Institution tier adds unlimited co-sponsors, complimentary inbound payments, accreditation, and security protections.

SyndicationPro pricing isn’t public, but it’s based on Equity Under Management (EUM). Those interested can contact the platform for a quote.

Best for

InvestmentNext is best for GPs and investor relations teams who want to scale their business from the early to mid-stages, while SyndicationPro is best for small to medium-sized real estate investment management businesses that want to automate their capital-raising processes.

Deployment & support

According to its website, InvestNext has an implementation speed twice as fast as the average in the real estate industry. Get up and running in days, not months, it states. The company also boasts of resolving over 90% of its support tickets within a day and a 95% customer satisfaction score.

SyndicationPro claims to migrate your existing real estate deals and investor database within 2 to 7 business days. The company also has a dedicated phone support line that’s open Monday through Friday from 9 AM to 5 PM Eastern Time (ET).

Integrations

Both InvestNext and SyndicationPro offer integrations with third-party apps through Zapier. You can synchronize either real estate investment management platform with email, Google Sheets, Slack, Airtable, and more.

Training software

Neither InvestNext nor SyndicationPro advertise dedicated training software on their websites. However, both real estate investment management platforms offer onboarding services and ongoing customer support. InvestNext also has a dedicated Learning Center with video tutorials and over 170 articles.

Ease of admin

InvestNext focuses on reducing administrative overhead with automated payment distributions and integrated accreditation and KYC/AML verification. In contrast, SyndicationPro focuses on making it easy to raise and scale real estate funds by allowing IRA investments, soft investor commitments, and collaboration with co-sponsors.

Ease of setup

Both InvestNext and SyndicationPro try to make getting started as easy as possible. For example, InvestNext offers a 5-part video series that walks users through setting up their capital raise, deal room, and investor portal. Similarly, SyndicationPro offers a free kickoff call and live platform walkthrough with a specialist.

Ease of use

Out of 20 reviews on Capterra, InvestNext scores 4.5 out of 5 stars for ease of use. In contrast, SyndiationPro scores 4.9 stars out of 15 reviews.

Platforms supported

Neither InvestNext nor SyndicationPro offers mobile app versions of their platform. However, both platforms can be accessed via a web browser.

Value for money

Out of 20 reviews on Capterra, InvestNext scored 4.7 out of 5 stars for value for money. SyndicationPro scored 5 stars out of 15 reviews.

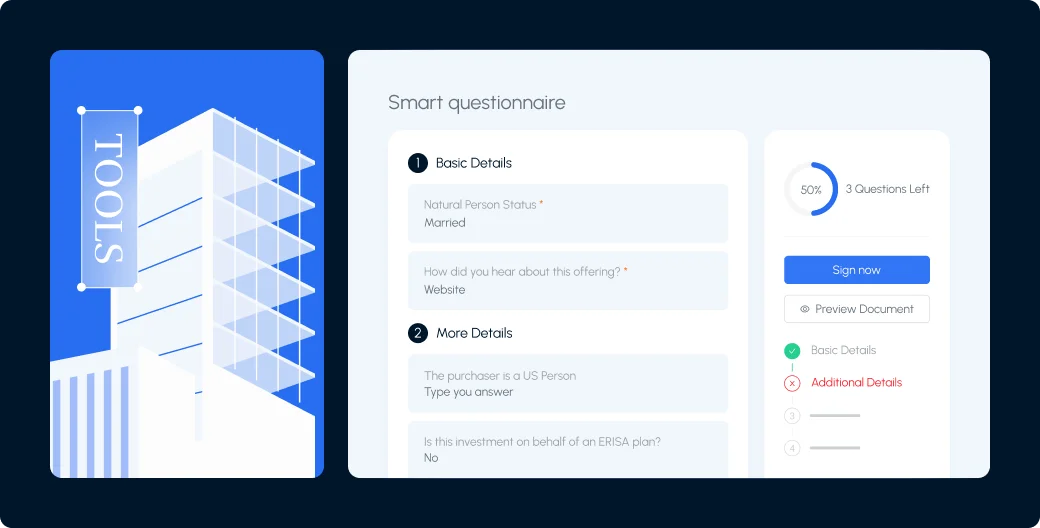

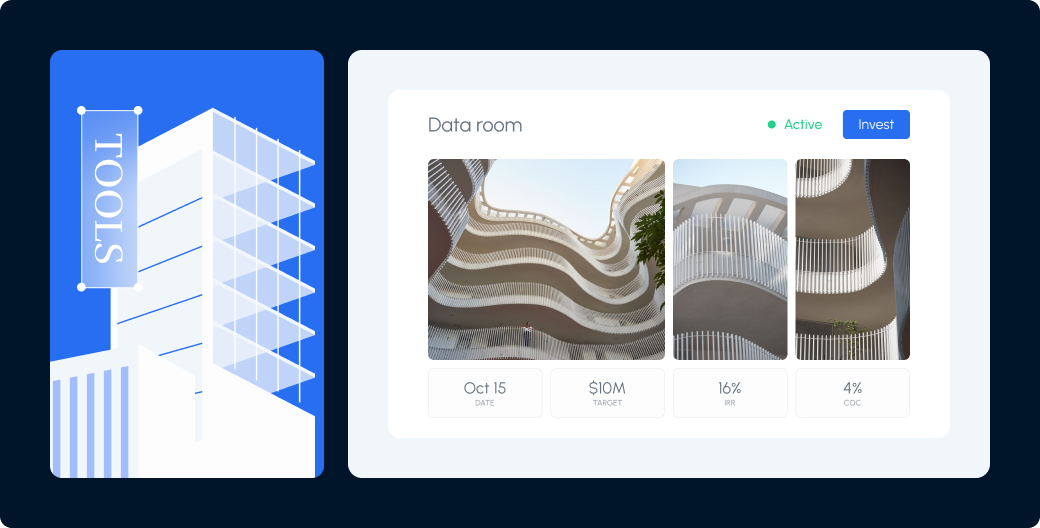

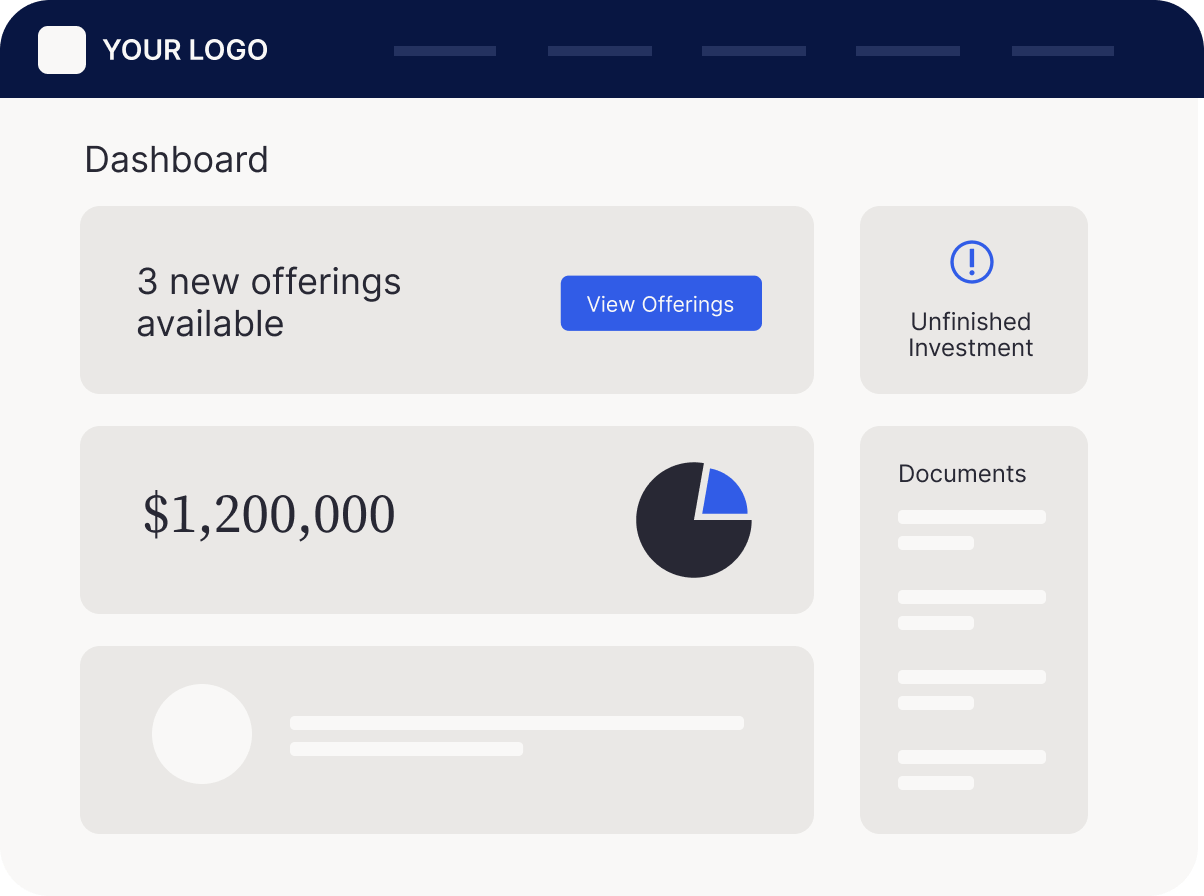

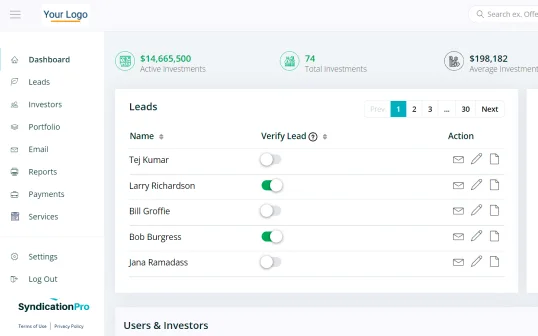

Product demo & screenshots

Both InvestNext and SyndicationPro let you schedule free demos by filling out a contact form on their websites.

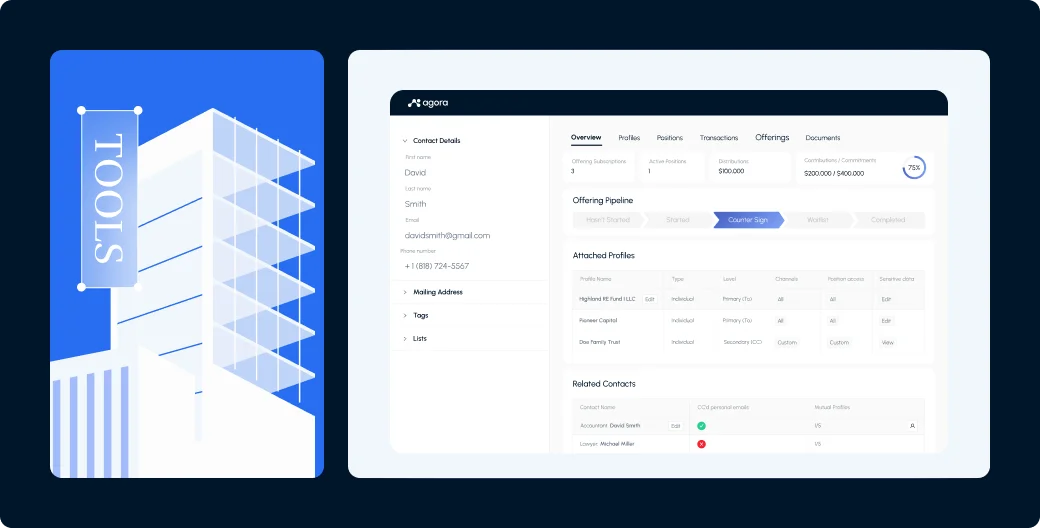

Here are screenshots of each platform’s CRM and investor portal:

| InvestNext CRM | InvestNext investor portal |

|  |

| SyndicationPro CRM | SyndicationPro investor portal |

|  |

Ratings & reviews

| InvestNext | SyndicationPro | |

| G2 | 4.5 (139 reviews) | 5.0 (2 reviews) |

| Capterra | 4.9 (20 reviews) | 5.0 (15 reviews) |

SyndicationPro has slightly higher user ratings than InvestNext. However, it’s important to note that SyndicationPro has far fewer reviews and fewer recent reviews than InvestNext. Overall, users are generally happy with both platforms.

Awards and recognitions

InvestNext’s website shows that it has received various recognitions including G2 Spring 2024 badges.

SyndicationPro’s website doesn’t show any recognitions received. However, it shows that the platform has been featured in Business Insider, Yahoo Finance, Benzinga, Businesswire, and other publications.

Alternatives

Outside of InvestNext and SyndicationPro, there are other real estate investment management platforms to choose from, many of which we’ve reviewed previously. These include Juniper Square vs SyndicationPro, InvestNext vs Juniper Square, and AppFolio vs InvestNext.

You may also want to consider Agora. Our investment management platform delivers real results for our customers with our comprehensive suite of tools, from increasing investor engagement to streamlining operations and boosting equity raises.

Our accolades suggest the industry agrees, with 10 badges in both the G2 Winter 2024 and Spring 2024 Reports. Our platform receives an outstanding 4.8/5 average rating, with customers highlighting the ease of use and onboarding. These success stories highlight our effectiveness as a next-generation investment management solution for forward-thinking commercial real estate investment firms.

InvestNext vs SyndicationPro: Which is the right platform for you?

Whether you should choose InvestNext or SyndicationPro depends on your investor management needs and situation.

Overall, the two platforms are very similar. InvestNext is a good choice for sponsors who want a predictable, tiered cost structure. SyndicationPro is better for real estate firms that want to automate their capital-raising processes with IRA funding, co-sponsor collaboration, and other unique features.

Conclusion

Ultimately, choosing the right real estate investment management platform requires due diligence. Carefully determine your budget, investor relations needs, and other requirements. Then study the available platforms in the real estate industry to see which ones check most of your boxes. Don’t forget to check user reviews and ratings and try demos to know how you like the user interface and design.

![AppFolio alternatives: Best property management platforms compared [2026]](https://res.cloudinary.com/de1ep59a0/images/v1768801446/Appfolio-alternatives_cover-02/Appfolio-alternatives_cover-02.webp?_i=AA)